Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing below:

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all RxR public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of RxR.

Please see here for full disclaimers.

Bring On The Autumn Seasonality

Last week was a positive period for the cryptoasset market, increasing 6.4% after global market capitalization bounced off its range lows of $1T.

As we’ve written extensively before, we see this as a strong support level with seasonality now pointing to greener pastures.

Markets are already extending their gains on Monday (+0.7%) with a confluence of moving averages (200d, 200w) that may act as near-term resistance at $1.1T. Still, we see the break out as realising the bullish RSI divergence that was formed last week (3d) with a break above $1.1T as signalling a bullish continuation pattern.

We can look to politics as volatility catalysts. The last-minute averted US government shutdown has removed fear of second-order effects (e.g. GDP slowdown) for investors.

Perhaps more interestingly, we continue to see China’s central bank continuing to stimulate by injecting into reverse repos to levels not seen since 2020. This comes as China’s latest economic data may be following a dynamic we see elsewhere including the US: the economy is beginning to bottom out with factory activity (PMI) expanding for the first time in 6 months.

On Bitcoin Centricity

When it comes to price action, BTC has already broken above $28.3k and the 200d/200w MA confluence…

A significant part of the news flow last week still centred around the prospect of a spot Bitcoin ETF being approved by the SEC. While several key applications were delayed, there was optimism that the SEC would approve a spot Bitcoin ETF sooner rather than later, given:

Growing demand from investors

Growing demand from managers (e.g. Franklin Templeton who is now in the game)

Growing demand from politicians (e.g. U.S. House Lawmakers pushing the SEC to act on ETF actions ‘immediately’ last week)

The prospect of high institutional flows to Bitcoin eventually has translated to relative strength in Bitcoin with market dominance maintaining its YTD support line. It’s worth remembering that October is usually a strong month for BTC (21% over the past 8 years).

We’re also paying attention to the regional banking sector which collapsed in early 2023 and was a catalyst for BTC’s outperformance in the market due to the narrative around hard asset collateral. The S&P regional bank ETF (KRE) has continued to make new lows since early summer as yield curves remain inverted.

We don’t see the regional bank situation as being the only catalyst for Bitcoin's relative strength, only that it adds to it.

Resiliency In A High Rate, High Dollar Environment

So the question becomes whether the broader market will rise with BTC. We think so, given seasonality typically uses a broad brush on markets.

The crypto market has remained resilient in the recent dollar strength/bond weakness environment where we typically see the opposite pattern ensue.

This could reflect the flush out of investors over the past 12 months and/or the market as forward-looking vehicles are sniffing out a regime change over the next 6-12 months.

Yet, investors and HF are still on the sidelines (Galaxy estimates ~40-60% invested) waiting for sideways price action to take us into YE. This aligns with crypto’s fear & greed index which stands at a neutral 50 today.

For risk on/risk off measures, stablecoin dominance has recently broken support. This break out speaks more to the decline in stablecoin supplies since April 2022 ($134B to $109B) but equally shows the market remaining buoyant without large net new flows of stables into the space.

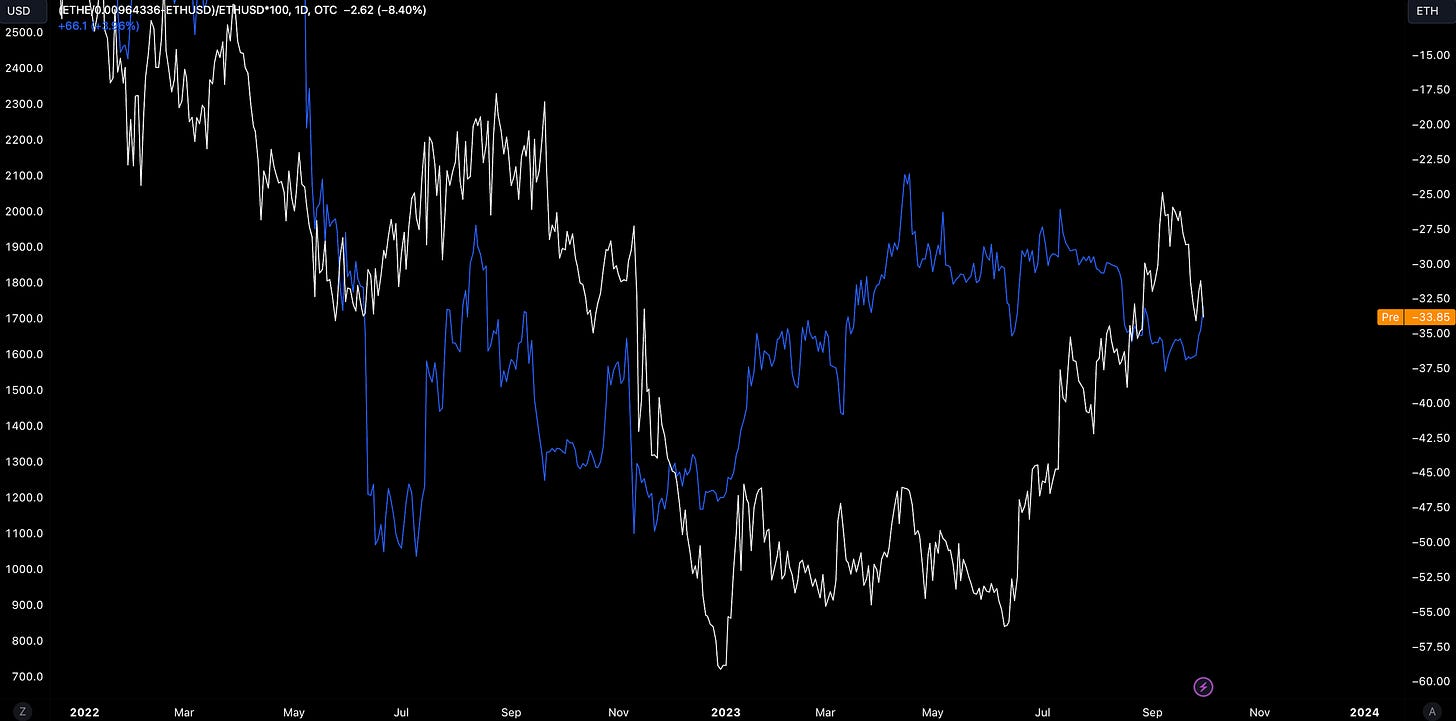

The ETH/BTC has remained relatively weak as a result but, for the longer-term investors, the outlook appears clearer. A potential further 15% underperformance vs. BTC before a possible 4-year wedge breakout sometime by June 2024.

We are more likely to see outperformance of higher quality names as investors regain confidence and play ball. For example, Solana has been leading the market over the past week (+28.4%) with SOL outperforming ETH by 16% since September EOM.

As we noted last week, SOL/ETH lags the ISM by ~20 months and an economic recovery outlook paints a constructive picture for the ratio well into 2024.

Web3 Native Business Models

Elsewhere, applications have been shrugging off price volatility and seeing clear PMF with brand-new business models native to Web3.

The social media platform Friend.tech has seen over $350m in protocol inflow since its launch in August. This inflow represents the volume of “keys” of accounts related to X accounts that are bought and sold.

When a key is bought or sold, a 5% fee goes to the app with 5% going to the channel’s owner with Friend.tech showing how sustainable Web3 business models change the game:

$313m revenue run rate

$50m user assets

$17.6m in protocol fees to date

306k users to date

Stablecoins: Showcasing the Convergence of Web2 and Web3

Despite broader concerns around the economy and price volatility, stablecoins have remained a bright light during the bear market. Global stablecoin volume has been kept buoyed above $1.1B monthly.

This marks a 10% decline from when global stablecoin supplies peaked in April 2022 at $134B where supply has contracted 18%.

In other words, stablecoins are seeing a slight increase in monetary velocity whereby users are transacting more relative to the monetary supply of stablecoins.

Note, that the below data uses single direction volume which removes any double counting transfer values.

USDT still leads in monthly volume at $189B with USDC coming in second at $53B. One key reason is that USDT primarily serves as an on- and off-ramp for investors and is frequently used for trading pairs on centralized exchanges.

Split out by chain, stablecoin volume has been heavily concentrated on Tron (50%) and Ethereum (41%).

Tron’s fast block time (3 seconds) and lower fees ($0.000005/tx) have allowed USDT to find clear PMF within the ecosystem.

USDT’s prevalence on Tron has been so in demand that the ratio of non-EVM (Tron, Solana) to EVM (incl. Ethereum, Arbitrum, Polygon, BSC, Avalanche) volume has been steadily ticking higher; now reaching new ATHs of 55%.

But elsewhere we see the Web2/Web3 convergence thesis playing out in real-time. Payment networks already see the disruption coming (24/7 remittances, fast processing times) and they are forced the hand of adapting their business model to stay relevant and in the game.

PayPal’s PYUSD stablecoin on Ethereum is now being tested in the wild.

While still in experimentation mode, PYSD has seen over $450m in total volume since its inception. PYUSD has a direct funnel to the largest cohorts of transactors: PayPal’s 426m users and Venmo’s 70 annual active users.

And it’s the protocol layer that stands to benefit greatly too. Ethereum’s network fees will apply as always with each PYUSD driving value back to ETH holders via the base fee burn.

Although Solana promises faster block times (800ms) and lower fees for payment it only houses ~1% of total stablecoin monthly volume. This may reflect short-lived PTSD following the collapse of FTX in November 2022.

PayPal’s PYUSD strategy was specifically halted following the exchange’s crash which eventually pivoted to Ethereum for its rails.

However, there are signals that Solana’s adoption may be catalysed by other means. In early September, Visa announced its stablecoin capabilities expansion with Circle’s USDC that would utilize the Solana blockchain.

To get a sense of scale/opportunity, Visa’s total payments and cash volume in 2021 was $13T. Forecasting using Solana’s 0.000005 minimum fee, the network could generate $15m in total transaction fees annually at 1% market penetration. In reality, the use of priority fees to guarantee the processing of transactions will likely drive these values at least 2x or more.

So one payment integration alone generating $15m in annualized network fees.

And just like Ethereum’s fee model, Solana burns 50% of total transaction fees, reducing the supply and offsetting supply issuance.

The convergence of Web2 and Web3 doesn’t just stop at stablecoins either - it applies cross-sector. UBS, one of the world’s largest fund houses, has just launched a test pilot of a tokenized money market fund on Ethereum.

This comes as Franklin Templeton CEO Jennifer Johnson calls tokenization the future of financial securitisation.

The value proposition is clear: the tokenisation of money market funds will enable the programmable tracking, trading, and management of these assets. The tokenization of $5.64T money market fund assets will help transform the global financial system as well as reshape the digital asset landscape - the definition of a perfect mutualistic relationship.

RxR’s Latest Thematic Research

On Ethereum's Valuation

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to RxR Research below: Disclaimers The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all…

Lewis Harland Featured in OurNetwork’s Latest Edition

Global Market Cap

$1.095T; Markets posting a 6.4% gain last week and are likely using the 200d/w MA confluence as a resistance zone near-term. Seasonality paints a constructive picture overall after the summer “lull”.

Bitcoin Dominance

49.8%; Bitcoin dominance making lower highs after breaking through 50% mid-June 2023. We are watching the 50% as the key support to break through if risk-on momentum takes hold into YE.

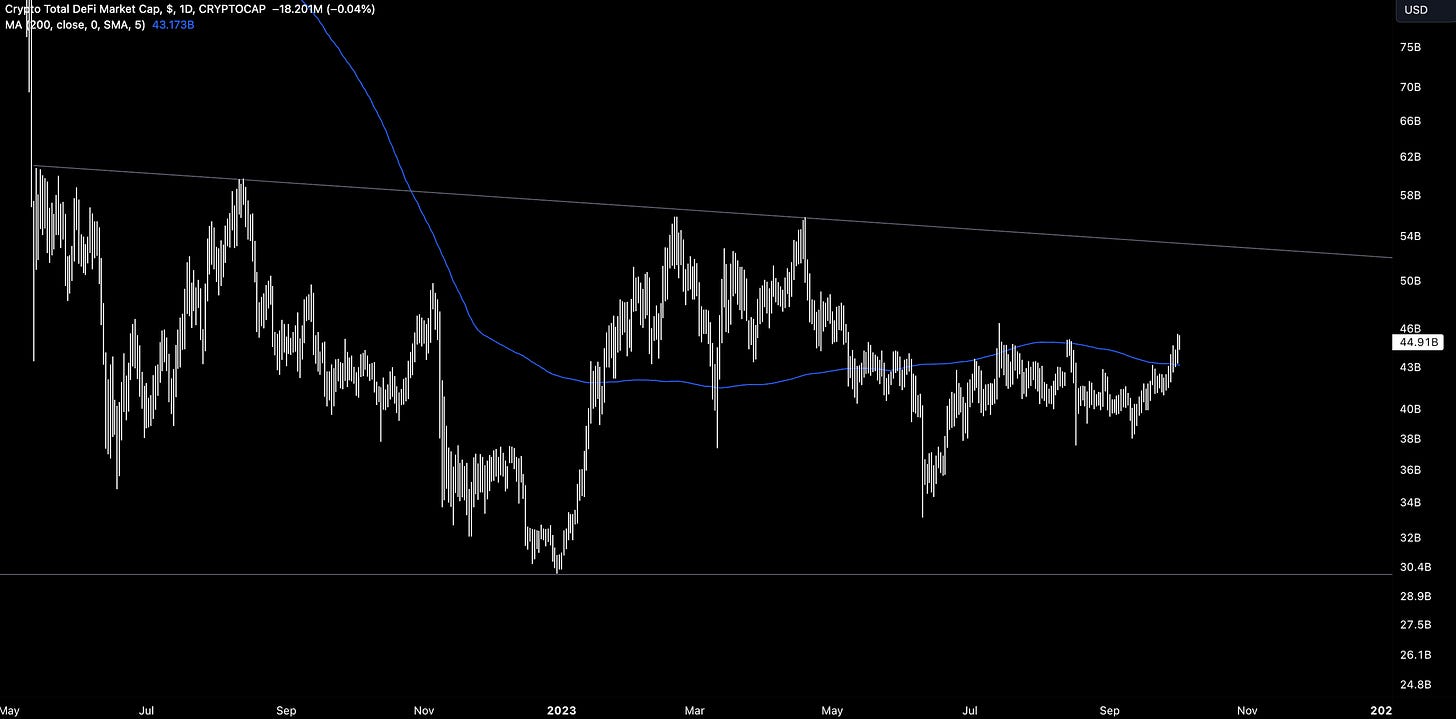

DeFi

$44B; The sector is finding some upside momentum posting a gain of 17% from its September lows of $38B. The conviction call will come from the sector’s breakout of its narrowing range (>$55B). Appears to be putting in higher lows since early summer.

Trader Positioning

BTC; BTC OI weighted funding rates remain choppy but overall positive indicating traders taking a predominantly bullish stance. Spike over the last 24 hours likely due to larger relative short liquidations (~$75m total).

ETH; ETH OI weighted funding rates are more positive overall with a similar dynamic playing out to BTC. Investors are gaining long conviction as opposed to removing it as prices climb higher.

Grayscale Trusts

GBTC; GBTC’s discount to NAV widening back to ~26% after narrowing to 19%. Indicates traders potentially removing risk from the plethora of SEC application delays.

ETHE discount also widening but to 34%. ETHE’s discount/premium direction should roughly mirror GBTC’s as the prospect of an ETHE spot ETF conversion is contingent on GBTC’s conversion success (i.e. sequentially modelled).

BTC/USD Aggregate Order Books

Order books look even. Heavier resistance up to ~$29k.

Miners

Bitcoin hash rate still climbing and is up 62% YTD in a show of resilience by miners.

Miners are also not looking to sell their BTC in aggregate either. The amount of BTC in miner reserves has not dropped below 1.8m since May 2023.

With 50% of miner rewards being cut in half next year due to the Bitcoin halvening, miners are likely doubling down on outcompeting on resources as well as their BTC holdings (i.e. bullish outlook into 2024).

Hashprice also seems to have topped out at 835m where the next mining cycle is set to begin as the halvening cycle looms ever closer.

Top performers are mainly a mixture of higher cap layer 1 blockchain names with top losers being largely centralized exchange tokens:

Top 100 (7d %):

Solana (+24.5%)

Thorchain (+24.1%)

Rollbit Coin (+22.6%)

BitcoinSV (+21.9%)

GMX (+21.0%)

Bottom Top 100 MCAPs (7d %):

Toncoin (-4.2%)

PAX Gold (-3.5%)

LEO Token (-2.7%)

Gate (-2.4%)

Huobi (-2.3%)

> ENS: Funding Public Goods, DAO Governance, L2 Scaling [0xResearch]

> The Summer of Protocols [Green Pill]

> How to build a $60B volume payments platform [The Fintech Blueprint]

> Breaking Down Barriers to Crypto Adoption [Money Reimagined]

> Elias Simos: Rated Network [Epicenter]

> On Liquid Staking’s Potential [Thunderhead]

> Solana's TVL Reaches $338.82M Despite Concerns Over Impact of FTX Estate Selling Crypto Holdings [Decrypt]

> Should Ethereum be okay with enshrining more things in the protocol [Vitalik Buterin]

> ETH Net Supply [Haseeb]

> On Rollbit Revenue [Rollbit]

Key RxR Links:

> Republic Crypto

> Re7 Capital

> Republic Group

About RxR

RxR is a fund partnership between Republic Crypto and Re7 Capital that leverages Republic Crypto’s leading Web3 advisory, venture capital, enterprise-grade infrastructure and treasury management capabilities, with Re7 Capital’s DeFi expertise and technology.

About Republic Crypto

Republic Crypto is a leading Web3 advisory with full-stack solutions for launching digital assets through consulting, token design and minting, and issuance solutions.

About Re7 Capital

Re7 Capital is a DeFi firm specializing in blockchain yield-seeking strategies. Its analytics engine gathers real-time data from 200+ protocols across stablecoin and ETH liquidity pools.