Market Pulse - 25th September 2023

Prices consolidate further as Q3 wraps up but seasonality may bring fresh momentum that many have waited for over the summer lulls.

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing below:

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all RxR public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of RxR.

Please see here for full disclaimers.

Local Momentum Extremes

It’s been another largely uneventful week for crypto valuations broadly with markets seeing a 1% decline last week.

Crypto market indices show the market is coming out of summer with very little steam. When we zoom out, we are still kept range-bound with a break below $1T signalling a bearish momentum pattern taking place.

Global Crypto Market Cap Index

Crypto’s weakness (or inability to gather upside momentum) is likely tied to the recent weakness seen in the broader equity markets. The S&P 500 has declined 4.16% in September with an overall 4 decline of 2.93% so far.

September was a month of central banks remaining hawkish on their path projection (despite no key rate increases) which strengthened the dollar to its March 2023 and weighed on risk assets.

On The Contrary

The key headwind for risk assets for many is this strong dollar driven by a US economic slowdown that is starting from a higher relative level to other countries - a favourable USD environment.

DXY (USD) vs. Global Crypto Market Cap Index

As we’ve highlighted before, equities were set to take a breather during the summer lull period and to re-trace closer to Fed Net Liquidity which began to front run in Q2 before an ISM recovery (economic growth vs. slowdown).

S&P 500 vs. Fed Net Liquidity

Remember, equity markets tend to be forward-looking - anticipating a gain in market liquidity well into 2024…

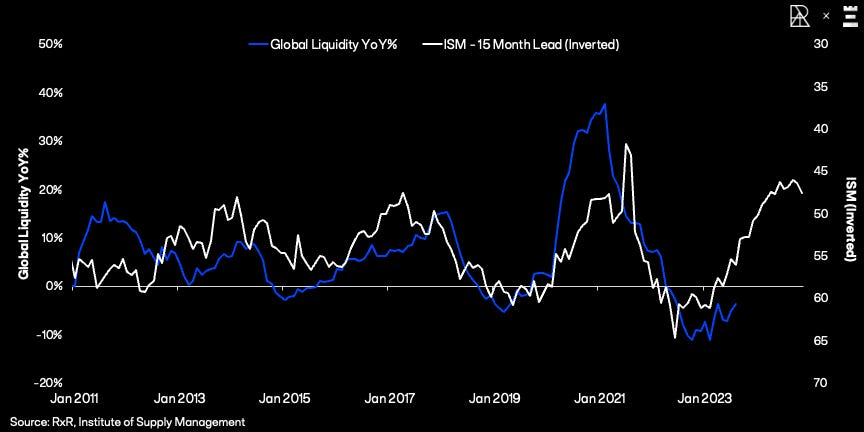

Globa Liquidity YoY% vs. ISM - 15 Month Lead (Inverted)

The bears are taking their victory lap with the September declines but valuations may now be overextended on the other side now. The market pendulum has swung the other way.

The S&P has just hit its most oversold level of the year - more than two standard deviations in the YTD log regression.

S&P 500 2023 Log Regression (2SDs)

SPX is also more than two SDs below its 50d MA which often marks momentum swings to the upside for several weeks.

S&P 500 vs. 50d MA % Delta

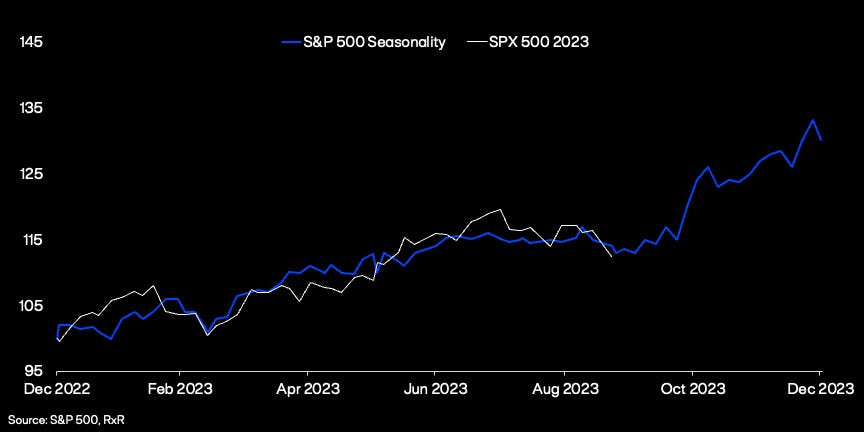

This potential reversal outlook aligns with seasonality analysis too with the upcoming Q4 period being the most seasonally bullish phase for equities.

S&P 500 2023 Performance vs. S&P 500 Seasonality Index

The Q4 Big Picture

Recession or not, growth in market liquidity will offset any inbound economic weakness which the equity market priced in October last year.

The forecasted positive growth rate in market liquidity over the coming quarters is often missed by those concentrating on backwards-looking (lagging) indicators.

The seasonality may not just stop at equities but trickle down the risk continuum over the months - aligning with key technical setups.

BTC/NDX is eyeing an upside break out in its bullish wedge pattern or ultimately failing by ~10 November 2023. Either move brings the fireworks.

BTC/NDX

For the ETH/BTC cross, it fell to its key support of 0.06 (support during May-October 2021) and resistance in June-July 2022 - an area of recovery rather than one of continued weakness.

ETH/BTC

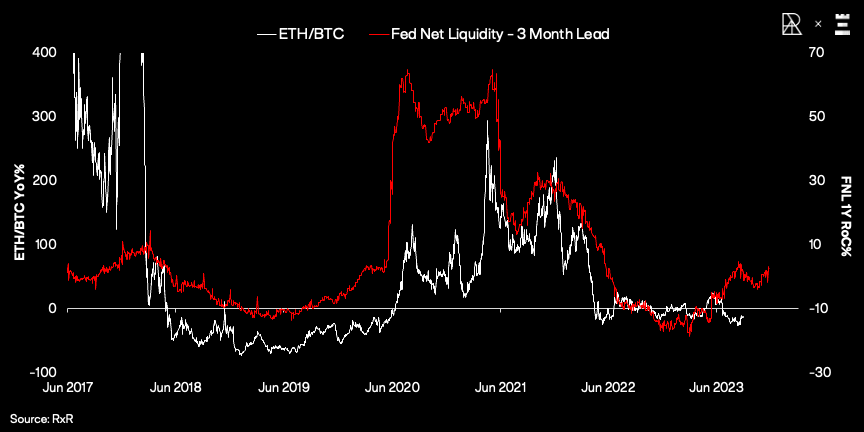

Rising liquidity also continues to suggest ETH is to outperform BTC, kicking off sometime in Q4 2023…

ETH/BTC vs. Fed Net Liquidity - 3 Month Lead

The recovery in the ISM also points to a positive ETH/BTC YoY price rate of change.

ETH/BTC vs. ISM - 20 Month Lead (Inverted)

Although using a more limited data sample, in theory, the same framework applies to other high-growth assets relative to beta. The SOL/ETH cross also lags the ISM by ~20 months and its recovery paints a constructive picture.

SOL/ETH vs. ISM 20 Month Lead (Inverted)

Finally, we are paying attention to several of RxR’s on-chain valuation models for networks. Bitcoin’s Metcalfe valuation model shows a spike in active addresses which on occasion has been a leading indicator for BTC price coming out of pronounced bearish periods.

BTC/USD vs. Daily Active Addresses

RxR’s Latest Thematic Research

On Ethereum's Valuation

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to RxR Research below: Disclaimers The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all…

Lewis Harland Featured in OurNetwork’s Latest Edition

Global Market Cap

$1.019T; Markets -1.1% last week and keeping within the $1T-$1.24T range. Weekly RSI neutral at 43 with no divergences. $1.1T is the next upside target to break with $1T being the next support to break.

Bitcoin Dominance

49.8%; Bitcoin dominance making lower highs after breaking through 50% mid-June 2023. We are watching the 50% as the key support to break through if risk-on momentum takes hold into YE.

DeFi

$41.46B; The sector still oscillating around the $40B mark since mid-2022. Its 200d MA is being used as a resistance zone, coupled with YTD trendline means a break of one of these measures by early November - the same period for the BTC/NDX break out.

Trader Positioning

BTC; BTC OI weighted funding rates remain choppy having had multiple resets over the past week. Positive rate spike in recent hours as BTC breaks below $26.25k.

ETH rates turning more consistently positive as traders take a predominantly bullish stance. Positive rate spike in recent hours for ETH too as $1.58k is broken to the downside.

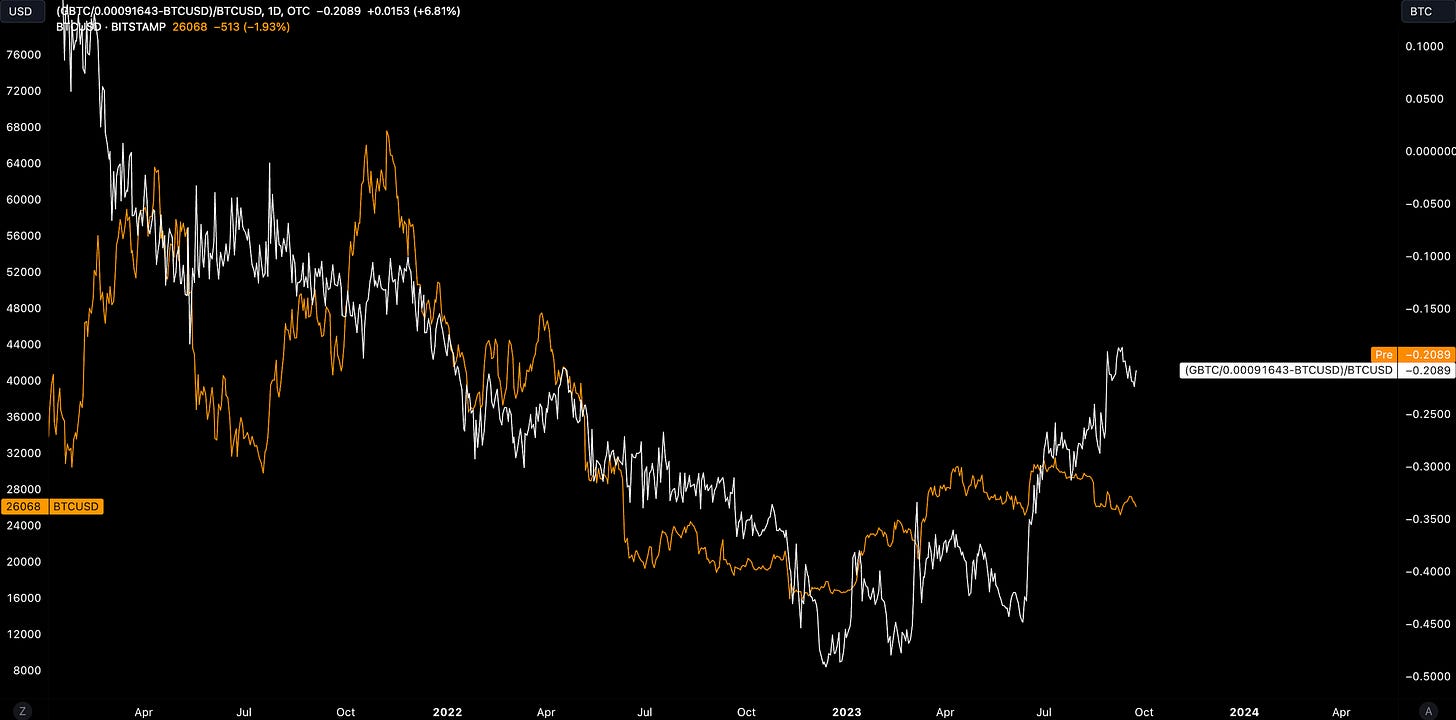

Grayscale Trusts

GBTC; GBTC’s discount to NAV seems capped at ~19% but equally keeping below 20% despite spot weakness over the last few weeks. Indicates traders remain resilient in their GBTC spot ETF conversion arbitrage trade.

ETHE discount to NAV capped at 24% (wider than GBTC reflecting lower conviction of an ETHE spot ETF conversion). GBTC and ETHE relative performance vs. spot will likely be catalysed by news flow regarding spot ETF applications and SEC positioning.

BTC/USD Aggregate Order Books

Order books are slightly heavier on the ask side. Heavier resistance up to ~$26.6k.

Miners

Bitcoin hash rate still climbing and is up 57.5% YTD. Divergence continuation between miner resource commitment and spot action since March 2023.

The climb in hashrate has driven mining difficulty to new highs. The hashrate/price ratio has reached peak levels in the previous cycle where a rollover in this ratio corresponds to constructive BTC/USD price action (BTC/USD ratio inverted below).

An alternative miner price index, miner revenue per hash, has completed its cyclical trend and is entering positive 1Y RoC. Miners have been doubling down on the resource commitment likely in anticipation of this.

Top performers are a mixture of alt L1s and blue chip DeFi names with bottom performers being predominately 2016-2018 names:

Top 100 (7d %):

WEMIX (+86.1%)

Curve DAO (+16.5%)

ImmutableX (+14.2%)

Chainlink (+9.4%)

Radix (+8.2%)

Bottom Top 100 MCAPs (7d %):

Rollbit Coin (-17.3%)

Optimism (-10.9%)

THORChain (-10.1%)

Toncoin (-9.7%)

Synthetix Network (-8.4%)

> On Sei [Fundamentals]

> Web3 Gaming: A False Hop for Crypto’s Path to Mass Adoption? [Lightspeed]

> MEV for Public Goods [GreenPill]

> MoneyLion’s evolution from neobank to financial education marketplace [The Fintech Blueprint]

> Why Protocols Should Advertise and When to Buy Your Watchlist [Empire]

> Volume 150: Digital Asset Fund Flows Weekly Report [Coinshares]

> Google Cloud Pushes Deeper Into Blockchain Data, Adding 11 Networks Including Polygon [Coindesk]

> Defining Characteristics of Networks [Chris Burniske]

> ETH Net Supply [Haseeb]

> Congressional Events vs. SEC Actions [Coinbase]

Key RxR Links:

> Republic Crypto

> Re7 Capital

> Republic Group

About RxR

RxR is a fund partnership between Republic Crypto and Re7 Capital that leverages Republic Crypto’s leading Web3 advisory, venture capital, enterprise-grade infrastructure and treasury management capabilities, with Re7 Capital’s DeFi expertise and technology.

About Republic Crypto

Republic Crypto is a leading Web3 advisory with full-stack solutions for launching digital assets through consulting, token design and minting, and issuance solutions.

About Re7 Capital

Re7 Capital is a DeFi firm specializing in blockchain yield-seeking strategies. Its analytics engine gathers real-time data from 200+ protocols across stablecoin and ETH liquidity pools.