On Ethereum's Valuation

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to RxR Research below:

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all RxR public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of RxR.

Please see here for full disclaimers.

Key Takeaways

ETH has many value layers that have emerged since Ethereum’s inception.

ETH valuation models should speak to each individual layer but also adapt as network economics evolve over time.

Scaling networks have been value-additive to Ethereum’s network valuation over the last 2 years.

RxR’s Metcalfe law-centric valuation models for ETH suggest ETH is trading below fair value by 27% once scaling network dynamics are factored in.

User growth on Ethereum as an application platform is set to outpace simple value-transfer networks over time implying higher relative valuations based on Metcalfe’s law.

EIP-559 provides a dividend income for ETH holders directly enabling network adoption to drive proportional value to ETH as a capital asset.

ETH currently trades at a premium to its economic activity since the launch of EIP1-559 in line with a discounted dividend model (DDM).

Ethereum’s rich set of application use cases catalyses higher network activity relative to less ‘expressive’ networks like Bitcoin.

The broader liquidity cycle has recently catalysed faster network adoption on the Ethereum but the market hasn’t priced in this growth in ETH relative to BTC.

What is Ethereum?

Often dubbed the "world computer," Ethereum's distinguishing feature lies in its ability to execute smart contracts and decentralized applications (dApps) on its blockchain. Unlike conventional centralized servers or cloud platforms, Ethereum's security and upkeep rely on a vast network of nodes spread across the globe.

At its core, Ethereum functions as a worldwide database enabling the execution of diverse computations. Users can store, create, and modify data for a fee, denominated in ETH.

Within this ecosystem, participants engage in activities like asset trading, fund transfers, margin and perpetual futures trading, execution of fixed and variable loans, art and collectable exchanges, gaming, and more. Moreover, Ethereum has evolved into the primary data storage solution for an extensive array of other blockchains and applications, essentially leasing out its network space.

A Refresher on ETH’s Value Layers

The below is an extension of Re7 Capital’s: How I Learned to Stop Worrying and Love ETH (2023)

There are multiple, interrelated valuation lenses that can be identified for Ethereum that speak to different aspects of Ethereum’s utility:

State - the data structure that holds accounts, balances, and its state machine. The value lies in the network being able to build on the entire tamper-proof transaction history through decentralised block production.

Network – the value in Ethereum’s network is proportional to the number of connected active users of that network.

Commodity – a consumable asset whereby economic value is derived from ETH being “fuel” for transactions and smart contracts.

Bond – a capital asset whereby value is derived from the ongoing source of yield by locking up ETH to secure the network.

Equity – a capital asset whereby value is derived from transaction fees paid by users and smart contracts to execute transactions. ETH is a share in the ownership of the Ethereum network.

There may be other emergent value layers that can be added such as Ethereum as a payment network.

So What’s ETH Worth?

To understand crypto network valuations is to understand crypto network design.

As an industry, we are only just beginning to scratch the surface of how to appropriately value the native assets of their respective crypto networks.

By being open-source and globally governed, Ethereum’s economic structures evolve over time too. Valuation models are forced to adapt in order to remain valid.

This is the case for any model at each of Ethereum’s value layers.

At RxR, we compile and track a comprehensive list of network and valuation models in relation to ETH’s value layers. In this article, we will analyze more emergent value layers which we will cover in this article.

Commodity Value

To transact (and store data) on Ethereum, transactors must pay ETH. This could be to stake, send a friend ETH, or borrow against a collateralised position.

Energy makes the world go around. The demand for energy (cars, factories) is what gives oil its global value. In a similar way, the demand for Ethereum’s blockspace is what gives ETH its commodity value.

On a daily basis, users allocate millions of dollars worth of ETH to facilitate their transactions. The annualized run rate of transaction fees stands at over $1.6B today.

Similar to ‘consuming’ oil to drive a car removes the commodity from the global supply, using ETH to pay for transactions removes ETH from the supply as part of transaction fees are ‘burned’.

EIP-1559, which launched on August 5th, 2021, was arguably the most significant upgrade to Ethereum’s network economics as it cemented an equity value layer for ETH. The upgrade made changes to how Ethereum calculates and processes network transaction fees.

With EIP1-559, a flat “base fee” is burned by the protocol and the base fee will adjust up to 12.5% based on how much demand exceeds the targetted gas limit per block until demand abates. The upgrade effectively provided an additional dividend valuation methodology for Ethereum on top of the commodity value layer.

This leads us to the equity value layer for ETH.

Equity Value

Ethereum also acts as a business which facilitates the coordination of services between suppliers and consumers. An example of this is decentralized credit applications offering fixed-rate lending for borrowers.

The higher the demand for participating in Ethereum’s network, the higher the fees and the higher the amount of ETH removed from the supply.

Therefore, the value of ETH is the present-day value of the sum of all of its future cash flows.

To date, over 3.5m ETH ($5.8B) has been burned by EIP-1559.

Some models like the GMI Network Value Model value networks as a function of active users times the dollar transaction volume. This approach has merit as it seems reasonable that the value of a network has to also factor in the value shared across those active nodes as an input.

To illustrate, these types of models would apply a higher value to a network with 2m nodes transacting $2B volume over time t than a network with the same number of nodes transacting just $5m.

Ethereum’s network valuation also seemed to track these models (named MLTV here) until EIP-1559 went live in August 2021. Since then, ETH has now consistently traded at a premium to the measure. This could indicate investors are already starting to price ETH as a capital asset via its ‘dividend’ properties where a higher premium is placed on a high growth network with a higher fee burn rate.

In theory, as Ethereum becomes a more active network, the more deflationary pressure that the burning of the base fee will have on the overall Ethereum supply. In other words, ETH holders have a share in a more valuable network with a potentially declining supply.

This activity will not only come from higher-value users transacting on the Ethereum L1 but also from lower-value users transacting on scaling networks that compile and submit transactions to Ethereum L1.

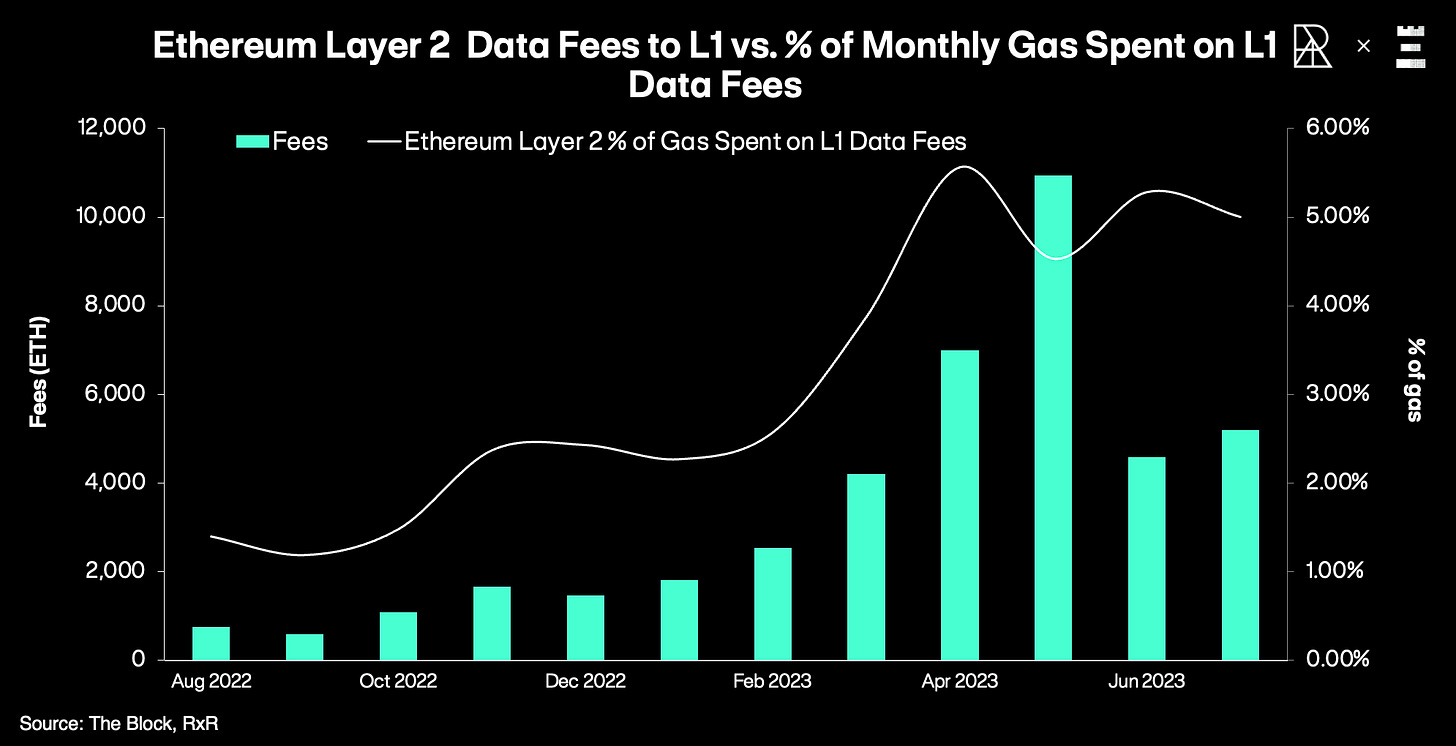

The fees paid by scaling networks for publishing data and security proofs back to the Ethereum L1 have been showing a clear trend upward as adoption has grown. Over 41k ETH has been paid by scaling networks over the past year.

The ratio of gas spent on L1 data fees by Ethereum’s scaling networks to total gas spent has also been increasing steadily. In other words, scaling networks are contributing more to Ethereum over time leading to more ETH burns.

Network Value

As we see with household social apps, the more active users that network has, the more valuable that network is. These ‘network effects’ apply to cryptonetworks like Ethereum too.

A Metcalfe’s law valuation approach can be applied to blockchain networks where the value of a network is proportional to the square number of active users within that respective network (n2) – a network is theoretically more valuable if each user is able to interact with a growing number of users.

For most of its history, Ethereum’s network value was tracking RxR’s Metcalfe’s Law Index fairly well. This initially shows that Ethereum has often been fairly priced according to the number of active participants within the network.

However, after March 2021, Ethereum has been trading at a premium to its active user base fair value. As with the equity value layer for Ethereum, we think modelling ETH’s network value should evolve as its network structure evolves too.

Ethereum Is the Sum of Its Parts

A key change in April 2021 was when scaling networks started contributing to Ethereum’s blockspace at scale. For example, Curve, Sushiswap, Decentraland, and Aave launched on Polygon (PoS) between April and May 2021 - these collectively drove the total value-bridged to Polygon to $10B.

In other words, derivative networks like Polygon’s PoS Sidechain were starting to provide a scalable foundation for a growing number of users that were, in turn, contributing economics back to its parent chain, Ethereum.

Fast forward to today and over 250 applications on Ethereum have a total value-locked of >$1m. Nearly 30 layer 2 networks have an aggregate TVL of $10B due to the advent of rollup-centric solutions.

We can adjust Metcalfe's Law model to incorporate the active user base of Ethereum’s scaling networks to create a more relevant model.

Ethereum’s network valuation tracks the updated ML index better when the active user base of Ethereum’s scaling networks is factored into the model than when omitted. You can also see that ETH fell from trading at a significant premium to its Metcalfe’s fair value to the model’s ‘fair value’.

The two models output very different fair values highlighting the importance of updating valuation measures as the respective network’s structure evolves. This could colour why previous analysis (see Fidelity’s recent ETH Investment Thesis) that only focuses on Ethereum’s L1 user base has become a less valuable predictor of network value over time.

The updated model, which does factor in these networks, puts ETH’s valuation at $275B (current MCAP trading at a 27% discount) assuming no further user growth in perpetuity.

Therefore, the current ETH opportunity is the current discount to its new Metcalfe fair value in a high-growth potential outcome. Below, we have modelled out ETH’s implied fair Metcalfe’s network value based on assumed growth rates in the ecosystem’s active users over the next 5 years:

With the proliferation of Ethereum scaling networks servicing a wider set of use cases, we see a reasonable chance of a 200% growth in daily active users in 2024 implying a $800B fair network value by 2025 (2.9x from current fair value and 3.9x from current FDV):

Note that it remains to be seen what decay function may apply to the Metcalfe model (if any) over the coming years which would reflect the view that each new user becomes incrementally less valuable than the existing set of active users within the ecosystem.

Ethereum’s Use Cases Catalyses Higher Network Activity

Ethereum is levied as the ultimate verification layer (e.g. submitting state root) as well as housing funds within smart contracts. Therefore, it makes sense that ETH’s value should also incorporate the economic contribution driven by users from its scaling derivatives in aggregate.

Ethereum is more than an alternative value-transfer system. It’s an alternative Internet financial system. Ethereum as a settlement layer for this new internet has provided a platform for a growing number of decentralized applications catering to a growing number of use cases and users.

Therefore, it’s no surprise that the number of active users within the Ethereum ecosystem has now overtaken Bitcoin in 2023. The rate of active users on Ethereum has also consistently outpaced Bitcoin as a function of days since launched.

And Use Case Adoption Can Stem From Macro

We can look to macroeconomics to model when users may be more likely to participate in networks too. The theory is that risk-on markets driven by global liquidity expansion are likely to catalyze user activity because more users will participate in Ethereum-based applications (e.g. speculating in NFT assets due to higher savings).

Longer-term, we see this relationship breaking down once transacting on decentralized networks is embedded within the fabric of our everyday lives.

As we highlighted above with Ethereum’s network value layer, higher user participation rates can translate to higher valuations. Therefore, we should expect periods of liquidity expansion to be met with relative outperformance of more expressive networks that enable a rich variety of use cases for end users.

And this is exactly what we see most of the time: A positive rate of change in the M2 money matches with a positive rate of change in ETH’s value relative to BTC (and vice versa).

So far in 2023, ETH/BTC has been trending down at a time when the rate of change in the M2 money supply has been recovering from the October lows in 2022.

Taken together, the broader liquidity cycle has catalysed faster network adoption YTD on the Ethereum network but the market hasn’t priced in this recent growth in ETH relative to BTC.

Final Remarks

Investors can point to the many value layers of ETH. New value layers emerge once network changes drive changes in specific economic mechanisms. Over time, it’s likely further value layers will form with new protocol upgrades that are implemented by the community. Valuation models need to be dynamic to encompass these changes which can be challenging.

But it is through these challenging efforts that we will be able to fully understand the value of the leading network powering the next Internet financial system.

Key RxR Links:

> Republic Crypto

> Re7 Capital

> Republic Group

About RxR

RxR is a fund partnership between Republic Crypto and Re7 Capital that leverages Republic Crypto’s leading Web3 advisory, venture capital, enterprise-grade infrastructure and treasury management capabilities, with Re7 Capital’s DeFi expertise and technology.

About Republic Crypto

Republic Crypto is a leading Web3 advisory with full-stack solutions for launching digital assets through consulting, token design and minting, and issuance solutions.

About Re7 Capital

Re7 Capital is a DeFi firm specializing in blockchain yield-seeking strategies. Its analytics engine gathers real-time data from 200+ protocols across stablecoin and ETH liquidity pools.