Market Pulse - 4th September 2023

Prices remain range-bound but Q423-Q2 2024 is shaping up to be the spring to crypto's winter.

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing below:

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all RxR public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of RxR.

Please see here for full disclaimers.

Quiet Crypto Markets

Another week in crypto, another range-bound week for markets. Summer is coming to a close and investors will be coming back to the same tune: sideways price action and low volumes.

But that’s OK. It’s business as usual. As we highlighted last week, markets have been kept between $1T-$1.23T YTD. Positive headlines only carry price for so long while negative headlines remain salient.

There is no better sign than when Grayscale won its legal battle against the SEC on August 29th creating a positive impulse from the range lows to the 200d MA only for the SEC to delay ETF applications (including BlackRock) just a few days later. The 200d MA was then used as resistance - all typical signs that the market remains cautious.

That said, we do note the hidden bullish divergence which may or may not have played out.

For BTC, the Grayscale win drove highs of $28.2k before coming back down to the recent range lows of $25.3k. Nothing really changes.

But this makes sense. Analysts are now seeing alternative arguments for rejections by the SEC as being the next move. At the same time, other analysts see a 75% chance of a Bitcoin spot ETF approval by year-end.

The regulator is expected to make its decisions on spot bitcoin ETFs in mid-October so investors are just playing the waiting game.

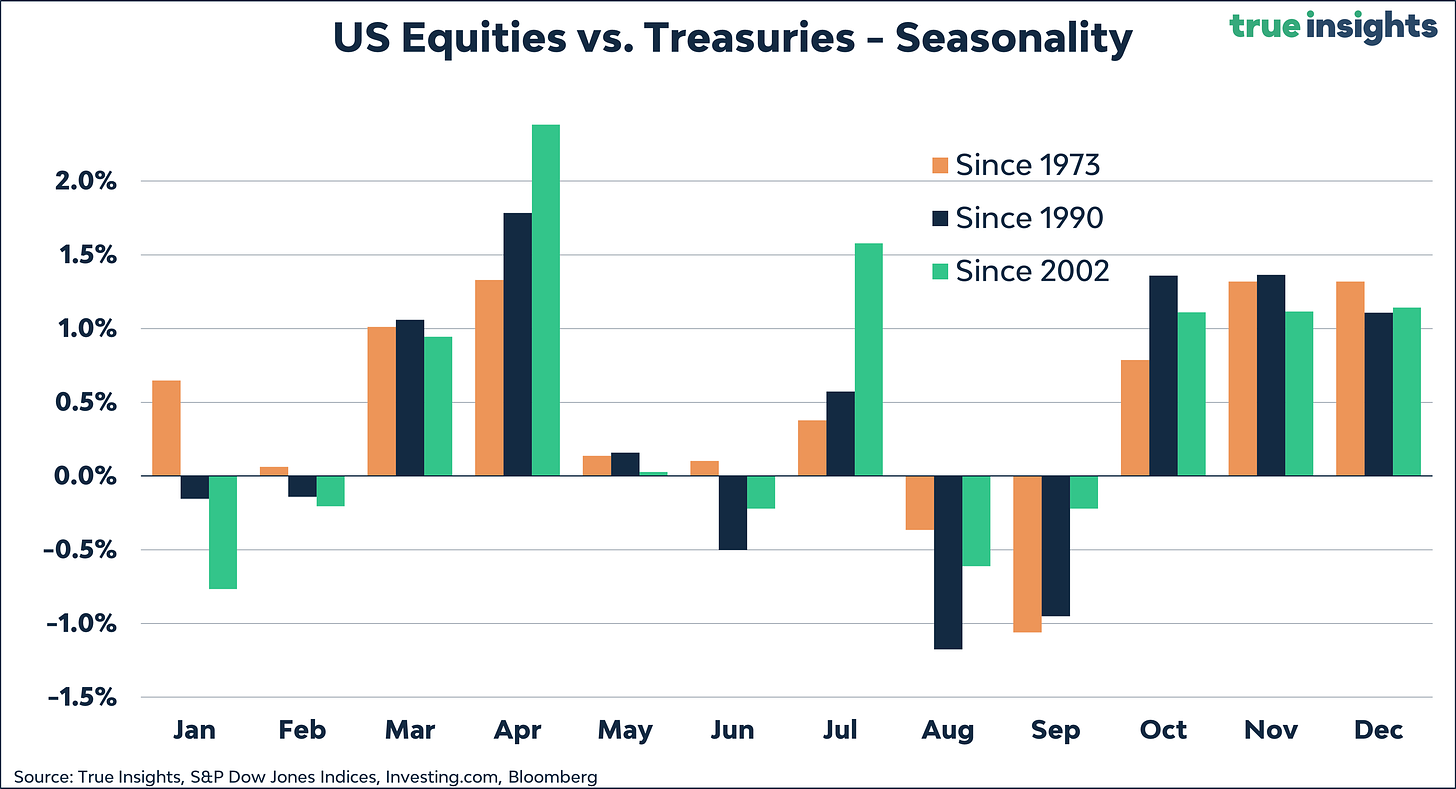

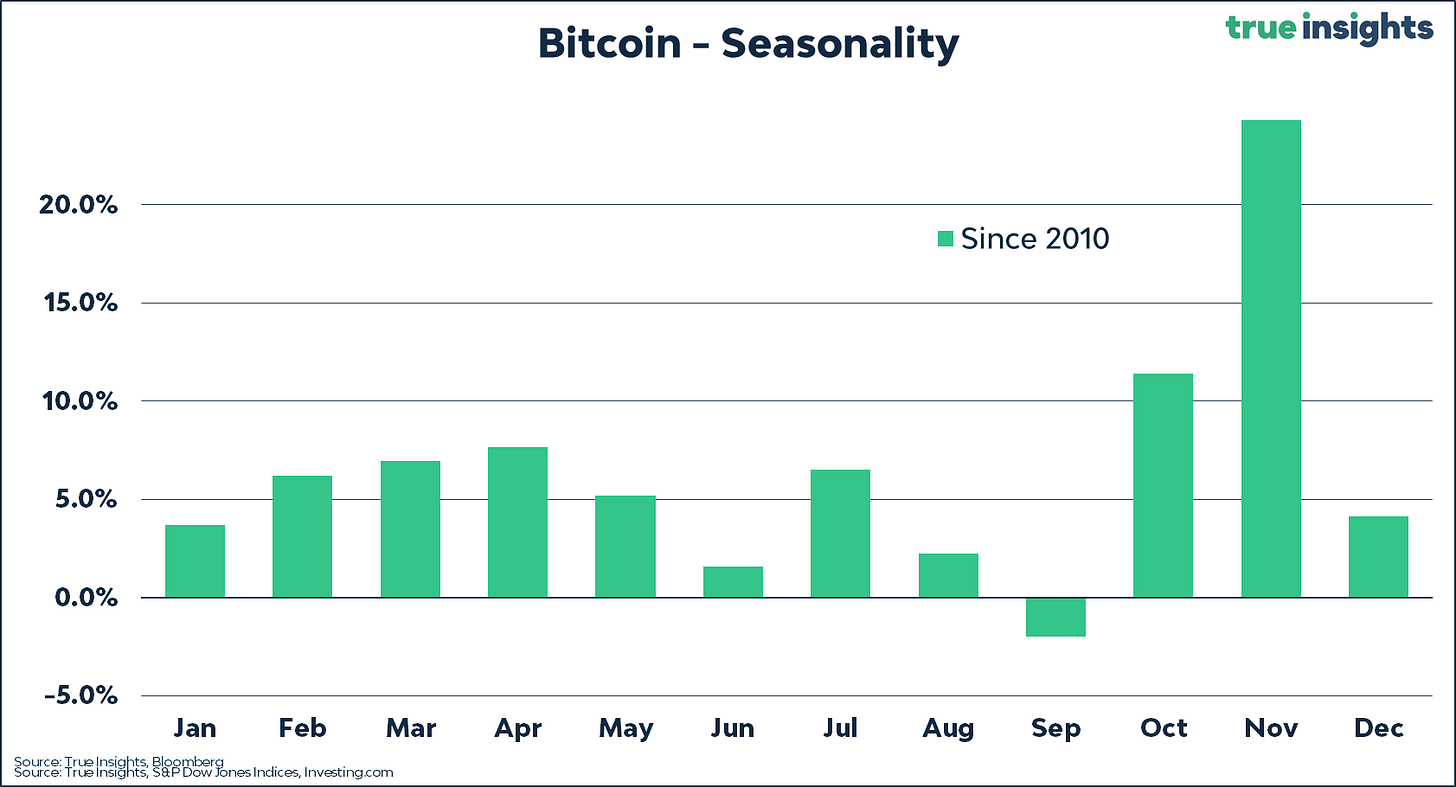

Seasonality of markets is likely also part of the puzzle. August and September are particularly challenging periods with investors away from their desks with no buyers.

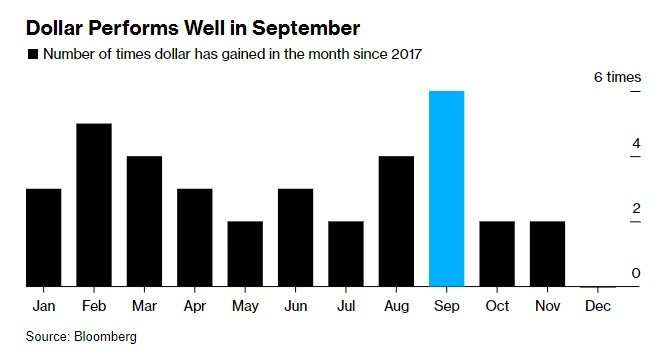

But it’s also worth paying attention to the dollar too. Remember, seasonality is a cross-asset phenomenon.

And because dollar strength means a strength in the dominator plus it is still being traded as a risk-on asset, BTC often takes the hit too.

Yet, what’s interesting now is that underexposed investors have been at risk after markets were pricing in a deep recession last year. Hedge funds are piling into equities to levels not seen since pre-pandemic when indices are just 3% away from their all-time highs.

SPX hedges are now the cheapest since 2008 despite the wall of worry: shadows of high inflation, economic recession, and the possibility of higher rates for longer. It might seem like a summer slog right now but investors are positioning for high liquidity and positive economic growth.

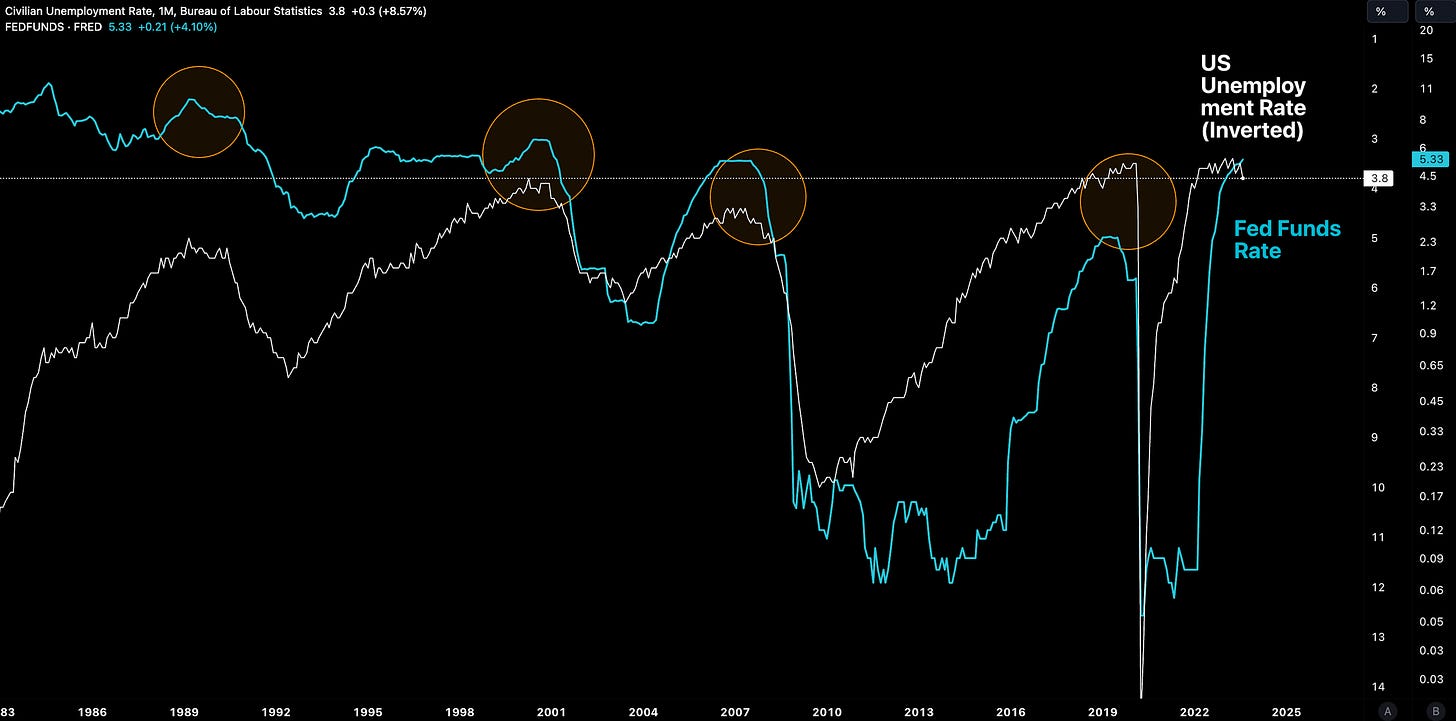

The latest macroeconomic data fits the model too. Last week, the US unemployment rate rose to 3.8% vs. 3.5% expectations. Higher unemployment with disinflation is the reason for Fed rate cuts and easing.

Q4 2023 - Q2 2024: The Golden Window

So past the potentially challenging seasonality, the macro picture is shaping up to be conducive for cryptoassets into year-end/beginning of 2024. One or two rising unemployment figures like last week and a recession will be in.

Remember, a 75% drawdown in cryptoassets is pricing in a fairly deep recession.

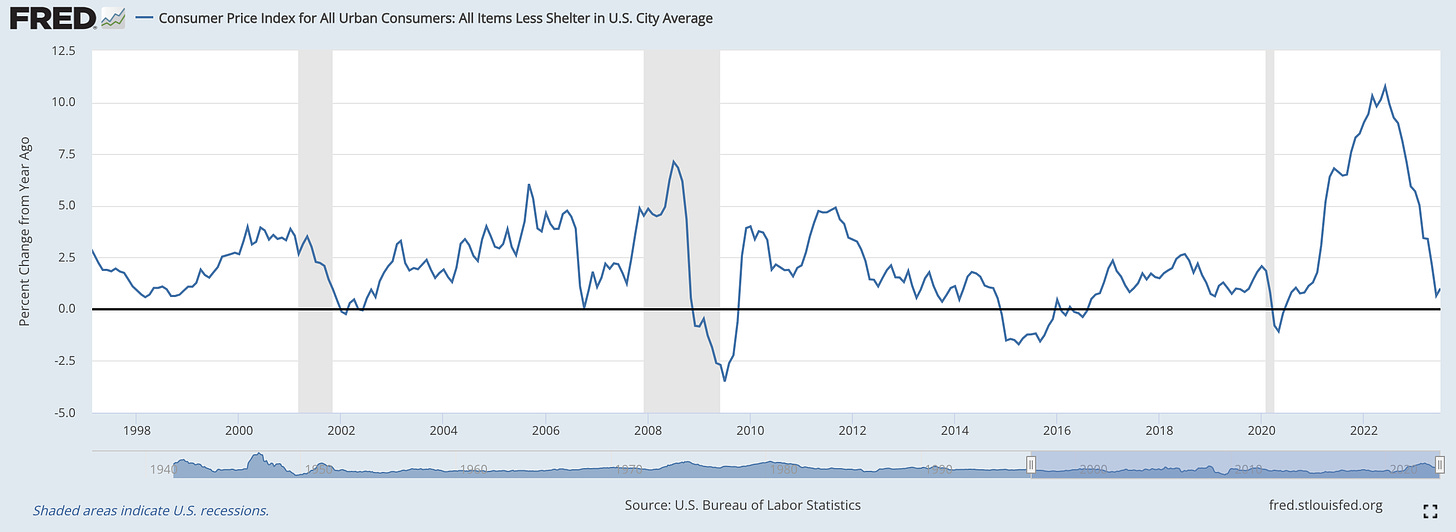

For prices, excluding the lagging shelter component in CPI, the YoY change reached 1% in July. PPI 1 month lead puts headline CPI at ~0% within the next 4 months.

Coming full circle, having inflation undershoot the 2% target by holding rates here provides the reason for the Fed to start easing once again. Why? Because they can issue more debt at lower rates to pay back the old debt in the previous debt cycle.

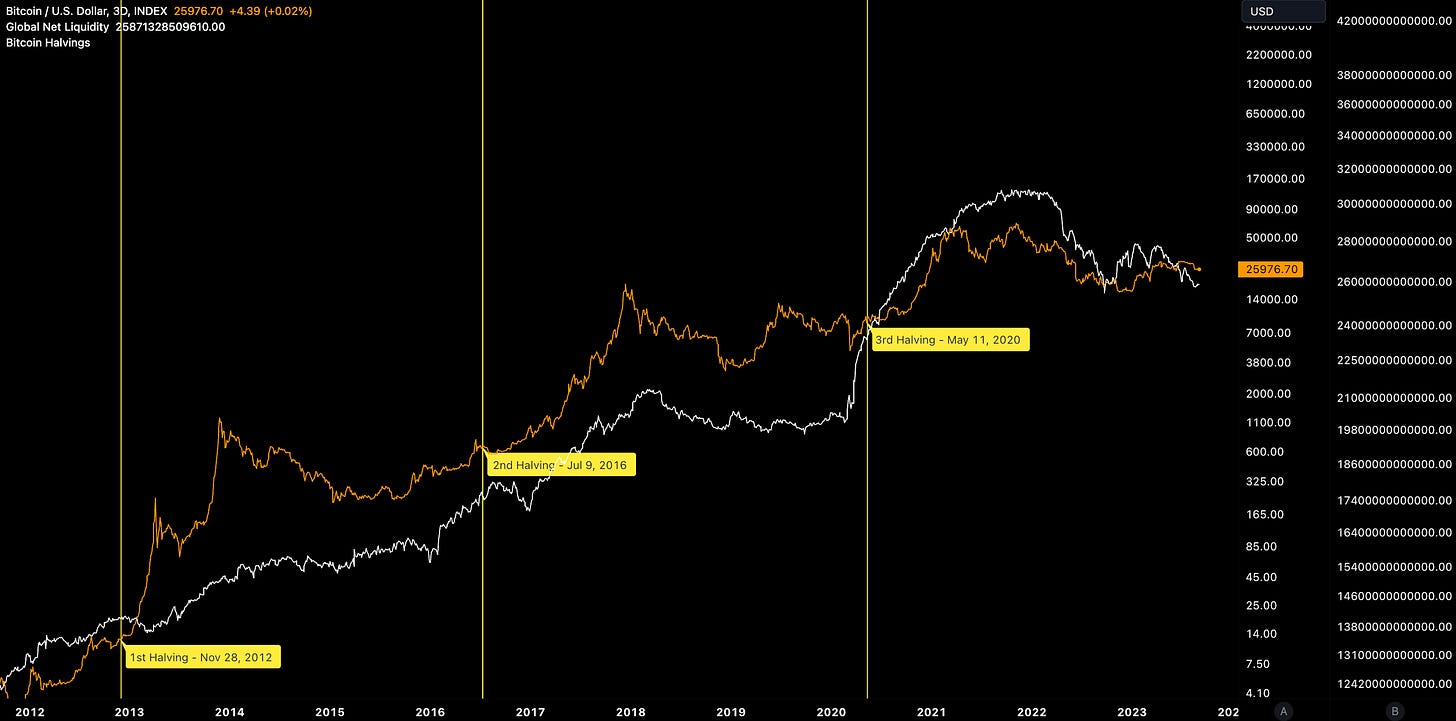

And it’s the debt cycle that matches up with the Bitcoin cycle given the great debt cycle reset in 2008 - just before Bitcoin was born in 2009 new year.

Central banks monetizing their old debt at low rates meant more money printing (therefore increasing market liquidity). It’s not the Bitcoin halvening event itself that drives price (supply), it’s the demand side of the equation where the expansion of central bank balance sheets occurs in and around the halvening events.

And it’s liquidity which is the key driver of asset prices over time.

So coupled with the likely approval of a Bitcoin spot ETF, you have a cocktail of positive supply/demand dynamics likely forming Q423-Q224:

Disinflation continuation, undershooting targets

Positive RoC in economic activity (e.g. ISM)

Higher unemployment rate (4.5%+)

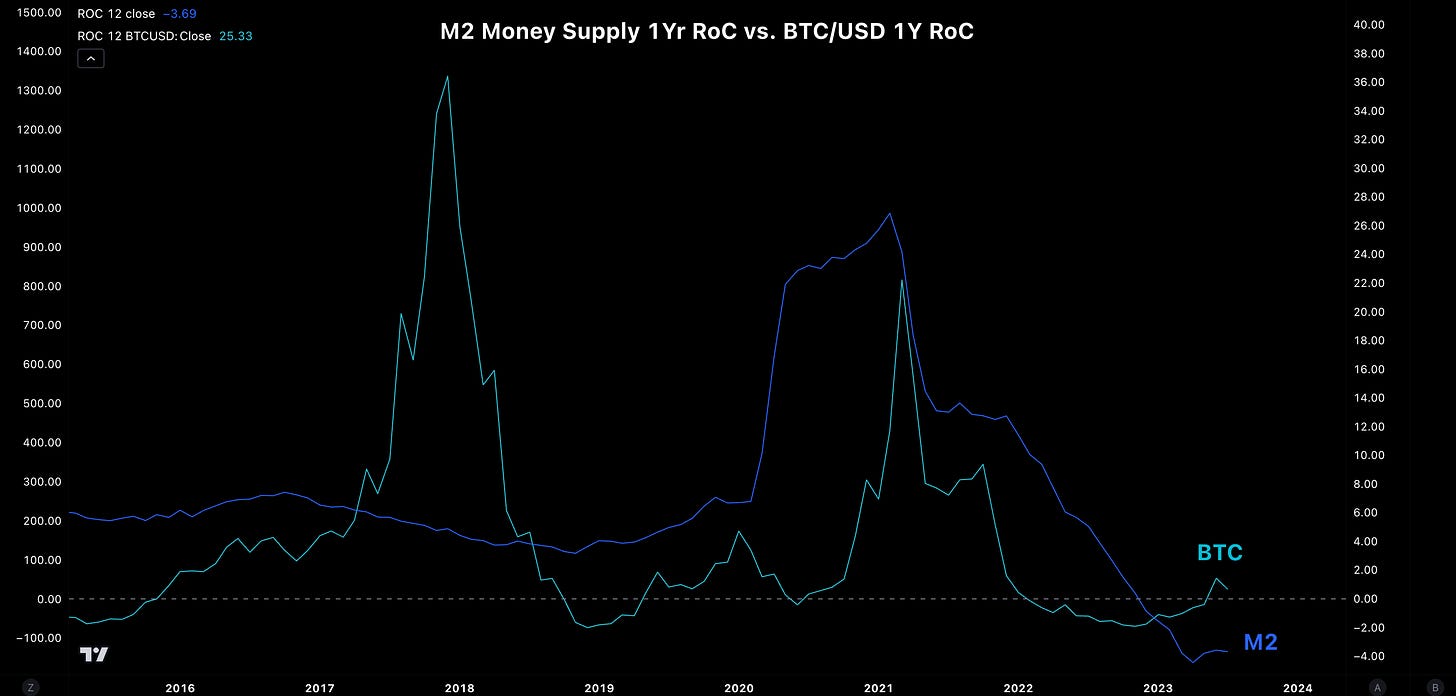

Positive RoC in M2 money supply

Bitcoin spot ETF approval

Bitcoin halvening reducing supply emission by 50%

Realized volatility reaching below 20 (30D) for the first time since January 2023 also signals huge moves over the subsequent 2-4 months which also lines up with our golden window:

April 2016: +83% (2 months)

October 2016: +85% (2 months)

March 2019: +214% (3 months)

July 2020: +102% (4 months)

January 2023: +85%(3 months)

The positive skew could reflect periods of lower market liquidity driving more muted price action. However low liquidity can only last so long in an increasingly leveraged, fractional reserve system before the liquidity calvary comes charging back.

This golden window period also aligns with our outlook on ETH’s outperformance to BTC due to ISM expansion from here on out.

In other words, it would represent capital rotation down the risk curve into names with high network effect potential (user and application growth etc).

And an ETH/BTC bullish wedge breakout is on the cards before Q2 2024…

We see a similar setup for alt coin indices too…

So overall, the skew appears to be positive and not negative. We are fast approaching a potential golden window of central bank balance sheet expansion as part of a course correction from undershooting inflation with cryptoassets standing to benefit from this turning of the tide.

On-Chain Signals

Bitcoin

Longer-term holders appear to be accumulating supply at a consistent rate. The rate of change of this supply by longer-term holders slows around the transition of the next bull run before distributing their supply during bull runs. Based on previous cyclical trends, BTC’s outlook is constructive over the coming quarters as Hodler Growth Index appears to have finished its expansion phase.

Bitcoin’s production cost, the cost of producing 1 BTC, puts a low of ~$22.3k. Bitcoin’s production cost valuation model puts BTC’s price floor as the cost to product 1 BTC into the market.

Ethereum

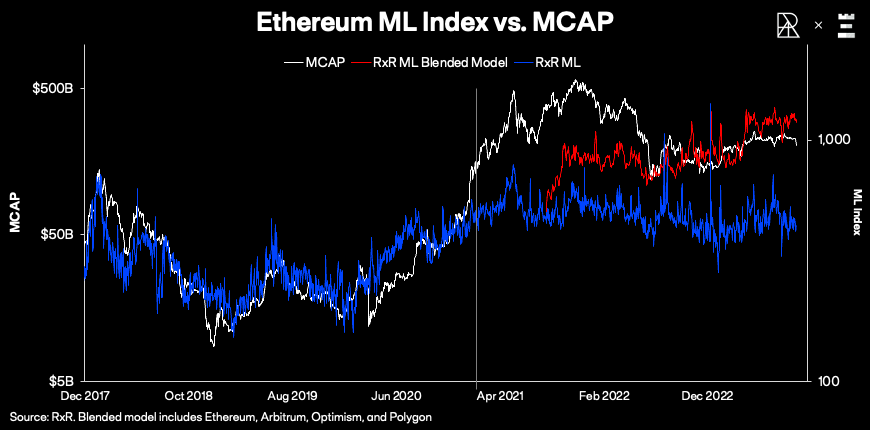

RxR’s Metcalfe’s law network valuation model for Ethereum suggests ETH is trading below fair value by ~30%. Metcalfe’s law valuation states that a network’s value is the square number of active nodes in that network.

RxR’s blended model below factors in scaling networks that are derivatives of the Ethereum ecosystem. A growing number of active users on a growing number of scaling solutions is catalysing a strong network effect for Ethereum long-term.

Stablecoins

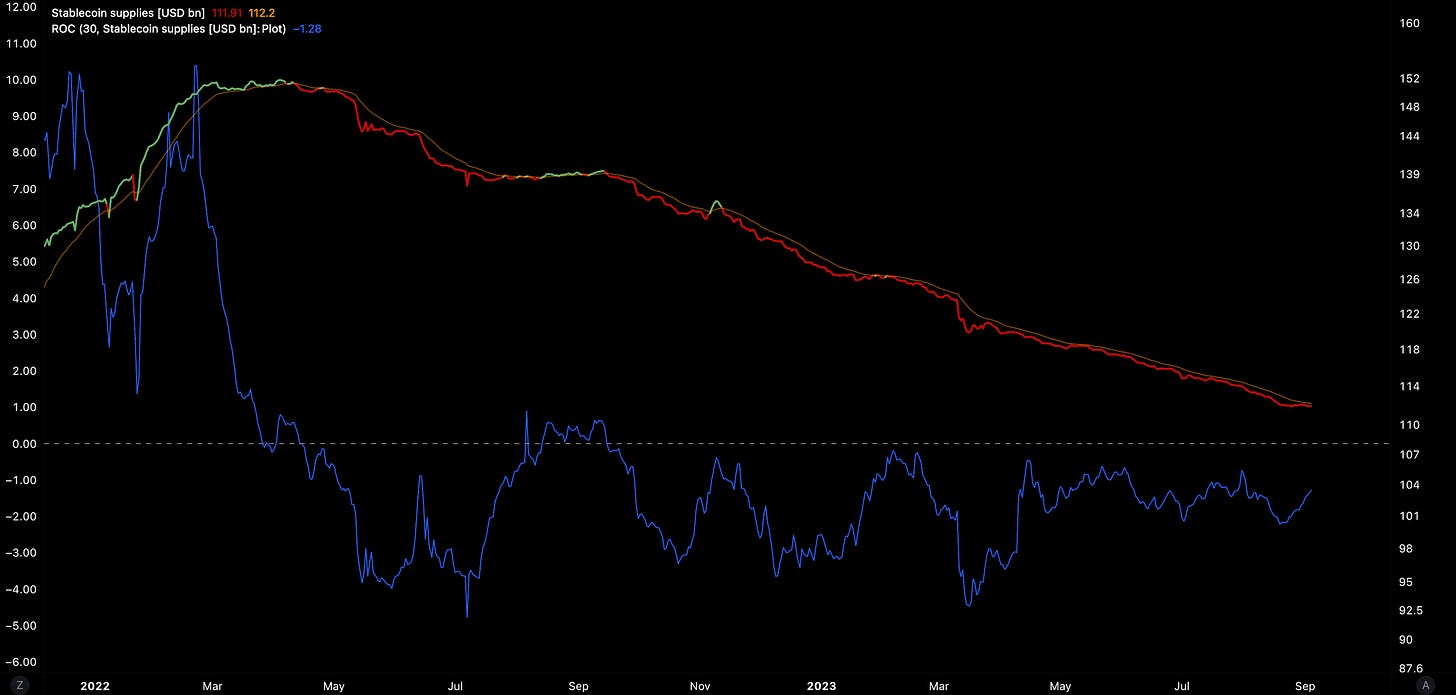

Global stablecoin supply has been extending its decline since April 2022 and currently stands at ~$111B. The 1-month rate-of-change turning positive could be an initial sign of more sustained momentum (intra-crypto liquidity expansion) which is likely to stem from exogenous liquidity expansion.

One of the key reasons for the exodus of stables is the higher real rates from central bank tightening vs. yields found in crypto sectors like DeFi.

RxR First Feature in OurNetwork

RxR covered macro analysis for Coinbase’s Base protocol in OurNetwork’s latest edition. OurNetwork is a community-powered crypto analytics providing public data-driven research to over 28,000 readers.

Global Market Cap

$1.025T; Markets were down by 0.8% last week with $1T appearing to be good support since March 2023. The next key break is the 200d signalling more sustained bullish momentum.

Bitcoin Dominance

49.26%; Bitcoin dominance finding support above 47% as forecasted earlier in August. ETF-related flows could buoy dominance above 47% but longer-term expect gravitation lower in line with recovering ISM driving outperformance of smaller cap names vs. BTC (e.g. ETH/BTC).

DeFi

$40B; The sector still oscillating around $40B market capitalization. Still looking to the 200d MA as a resistance test.

Trader Positioning

BTC; BTC OI weighted funding rates have remained positive for the most part reflecting a predominantly bullish stance overall but this is inconsistent (cautious). Shorts outpacing longs (either shorts rejecting Grayscale win as positive or longs closing position opportunistically).

ETH rates are more neutral/negative with traders more indecisive in their outlook.

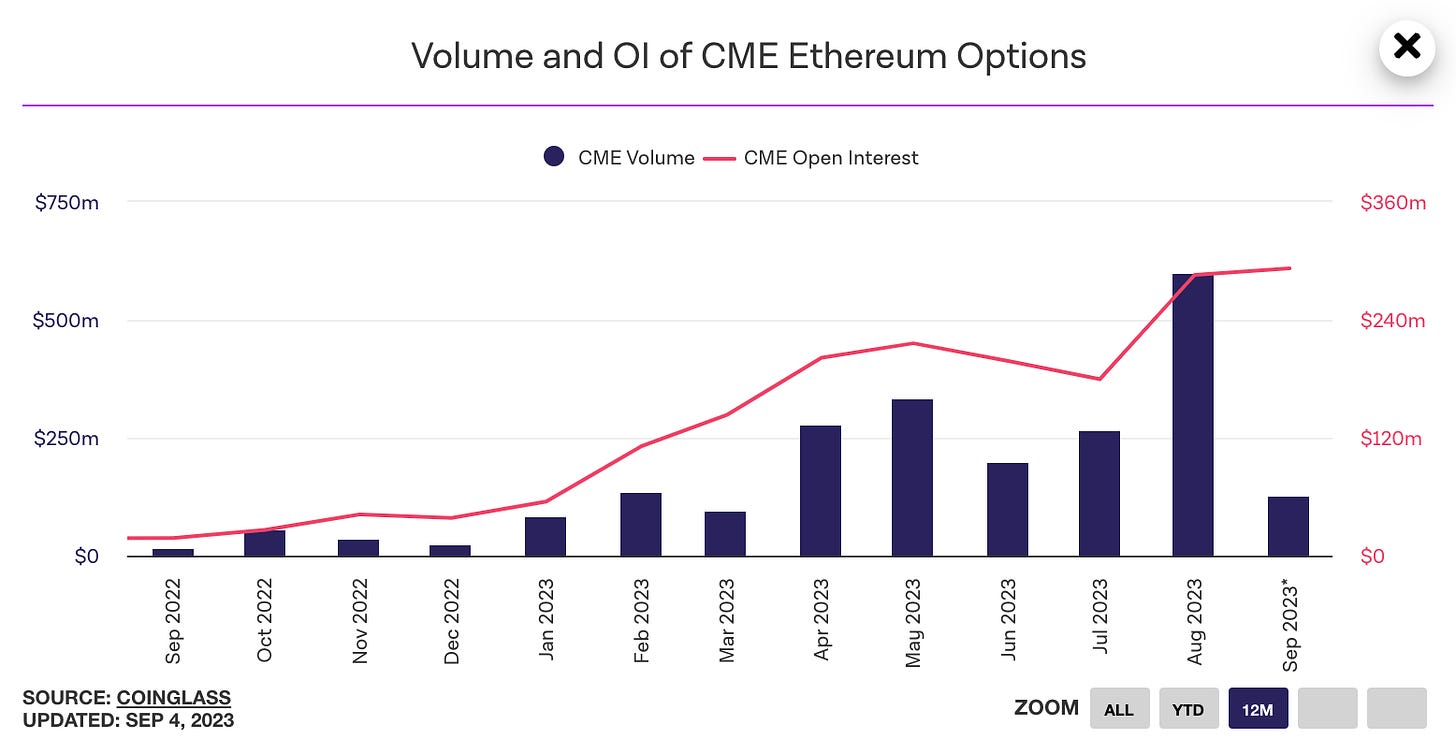

Ethereum options volume reached new ATHs in August ($600m) - nearly 45% of Bitcoin’s total for the respective month. Institutions (more likely to use CME) are increasingly participating in ETH markets with a surge in volume possibly indicating a higher appetite to hedge their positions.

Grayscale Trusts

GBTC; GBTC’s discount to NAV narrowed to a low of 19% last week before expanding slightly to 22%. Narrowing of the discount reflects the growing likelihood of a successful GBTC conversion to a Bitcoin spot ETF. The persistent discount despite the Grayscale win likely reflects:

Uncertainty around Grayscale’s ability to convert

SEC’s ability to form new arguments for rejecting ETF applications

Timing uncertainty (time discount). GBTC is still close-ended.

ETHE discount to NAV at ~32% with investors playing the (longer-term) trade of a successful ETHE-ETH spot ETF conversion (with a higher discount rate).

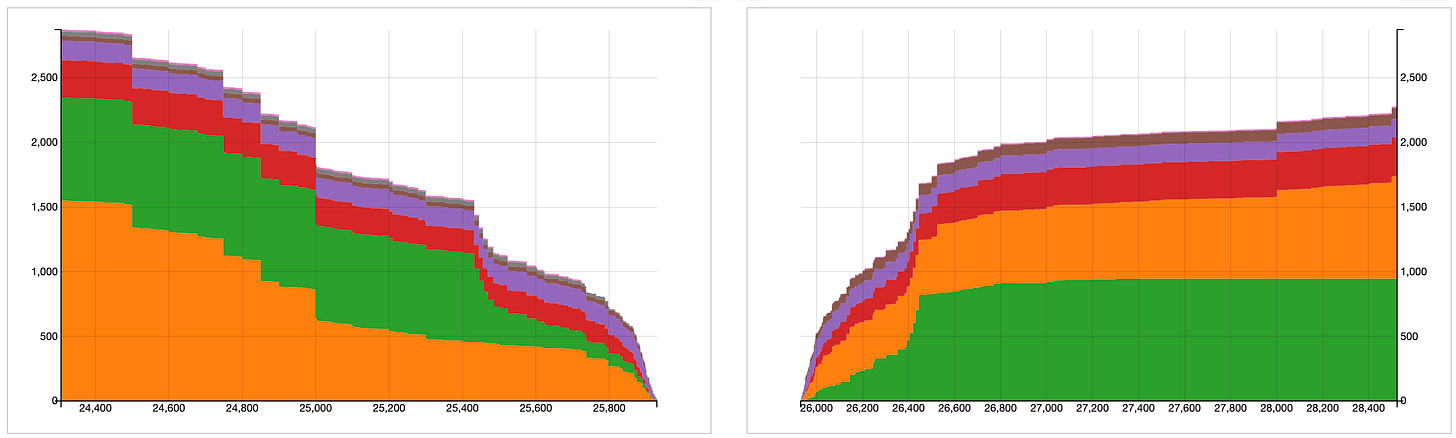

BTC/USD Aggregate Order Books

Order books are slightly heavier on the bid side. Heavier resistance up to ~$26.5k.

Miners

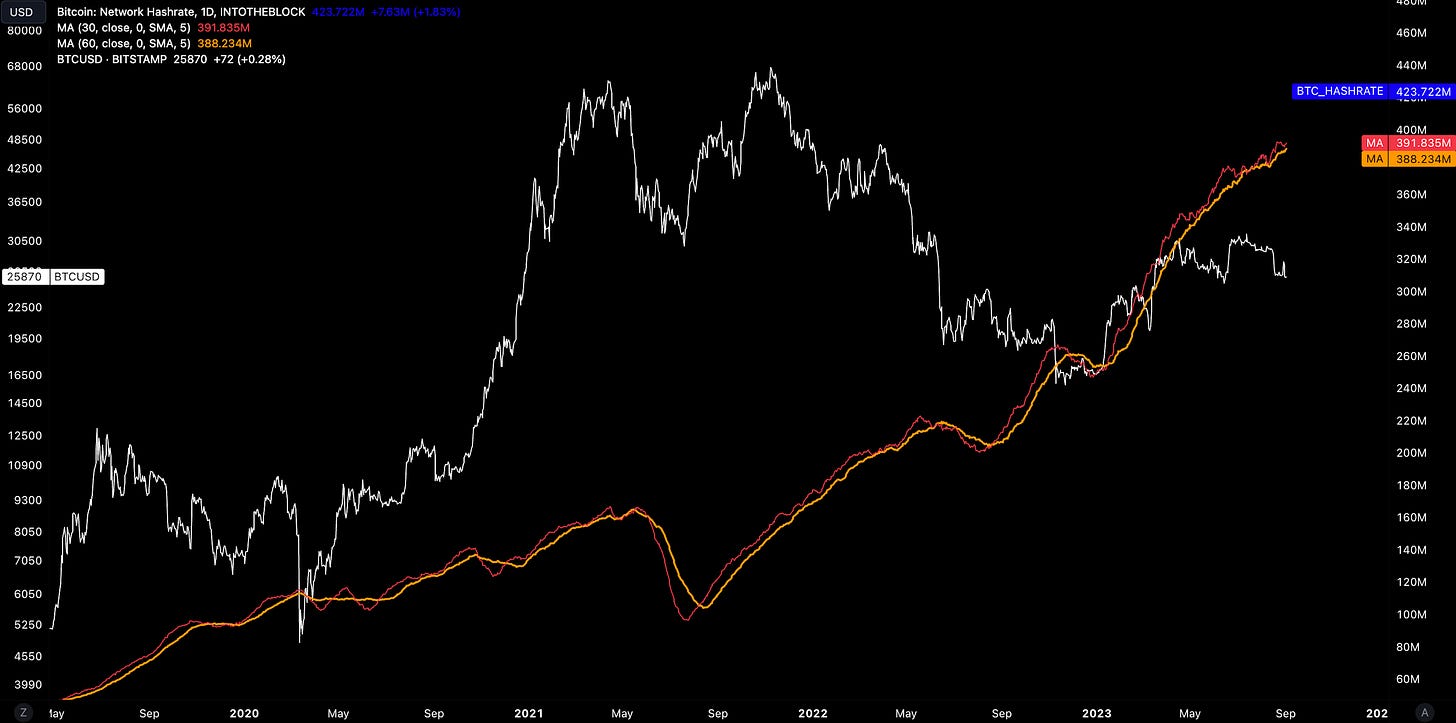

Bitcoin hash rate still climbing and up 57% YTD. Divergence continuation between miner resource commitment and spot action since March 2023.

Hashprice continues to edge higher as miner commitment strengthens but is not met with stronger price action (network security is outpacing market valuations). This exposes Bitcoin mining operations in order to remain profitable but equally may mean valuations need to ‘catch up’ to reflect the increased resources being used to product the scarce digital commodity.

Rate-of-change analysis points to a likely reversion in hashprice (vs. further rally) which is often met with a positive rate-of-change for BTC prices historically.

Top performers are a mixture of alt L1s and blue chip DeFi names with bottom performers being predominately alternative L1s:

Top 100 (7d %):

Toncoin (+28.6%)

IOTA (+16.5%)

XDC Network (+10.1%)

Rocket Pool (+8.2%)

Maker (+8.2)

Bottom Top 100 MCAPs (7d %):

Rollbit (-14.4)

Hedera (-13.2%)

Gala (-23.3%)

Sui (-10.3%)

KuCoin (-8.4%)

> The Blockchain Trilemma - ETH vs. SOL vs. ATOM [Bankless]

> L2 Wars, FriendTech, Crypto Regs, Digital Art Movement [Empire]

> SEC Defeats, Binance Intrigue, and a Bitcoin Flop [The Break Down]

> Unpacking the Market Structure Bill [The Scoop]

> Canonical Crypto - Anand Iyer [Scenius Studio]

> Huobi’s spot market share jumps to the highest point in two years [Blockworks]

> Vitalik sells MakerDAO stake after CEO Christensen suggests Solana-based blockchain [Blockworks]

> ApeCoin, Aptos and Optimism set for $100 million in token unlocks this month [The Block]

> OurNetwork - L2s [OurNetwork]

> Chainlink CCIP Revenue [LittleBirdz_]

Key RxR Links:

> Republic Crypto

> Re7 Capital

> Republic Group

About RxR

RxR is a fund partnership between Republic Crypto and Re7 Capital that leverages Republic Crypto’s leading Web3 advisory, venture capital, enterprise-grade infrastructure and treasury management capabilities, with Re7 Capital’s DeFi expertise and technology.

About Republic Crypto

Republic Crypto is a leading Web3 advisory with full-stack solutions for launching digital assets through consulting, token design and minting, and issuance solutions.

About Re7 Capital

Re7 Capital is a DeFi firm specializing in blockchain yield-seeking strategies. Its analytics engine gathers real-time data from 200+ protocols across stablecoin and ETH liquidity pools.

Disclaimers

The information provided on this website by RxR Republic Re7 Limited ("RxR") is intended for general informational purposes only. It should not be considered as investment advice or a recommendation to buy, sell, or hold any cryptocurrencies or related assets. RxR is not a registered investment adviser and does not provide personalized financial, investment, or tax advice. You should always consult with a qualified financial advisor before making any investment decisions.

The content presented on this website should not be construed as financial, legal, or tax advice. RxR does not endorse or control the content of third-party sources linked from this platform, and it cannot guarantee their accuracy, reliability, or relevance.

Reference to any specific cryptocurrency, exchange, service, or project on this website does not constitute an endorsement or recommendation by RxR. Any opinions expressed are solely those of the authors and do not reflect the views of RxR. Conduct your own research and due diligence before engaging in any transactions or investments.