Market Pulse - 16th October 2023

A changing of the tide for stablecoin supplies is on the horizon.

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing below:

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all RxR public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of RxR.

Please see here for full disclaimers.

Edging Higher

Crypto markets slid for a further week, declining 2.9% in what was a fairly non-eventful week.

The much too familiar range price action between $1T-$1.24T remained the same. As a reminder, the 200d MA has been the resistance zone over the summer.

Yet, we see bright spots with Bitcoin which began to see a positive impulse on Sunday after reaching a weekly low of $26,533.

It’s shaping up to be an interesting week: BTC is at $27,829 and at the 200d MA - the resistance line ($28k). The upside momentum confirmation will come from a sustained break above $28k.

For ETH, the set-up remains negative relative to BTC for now due to a number of factors likely working together directionally including:

ETH becoming inflationary from limited fees paid/burned by on-chain transactors (+0.37% ann.)

Lack of futures ETF demand

Dencun upgrade delayed until 2024

BTC’s Sunday impulse comes as the SEC chose not to appeal their loss in the Grayscale case which the market has taken as increasing the odds of a US spot Bitcoin ETF approval.

The prospect of a US spot Bitcoin ETF approval and the halvening have been arguably the clearest price catalysts within the cryptoasset market.

Zooming in, BTC’s price jumped on the news by a measly 0.9% on Friday. There then seems to be a 1d 18hr delay from headlines to the more dramatic 4% jump on Sunday.

So what happened? Of course, it’s possible BTC’s jump isn’t related to the ETF news. It could also be a delayed reaction to something that was already baked into the price.

Our take is that not appealing to the SEC boosts the chances of a successful Grayscale Bitcoin Trust to spot ETF conversion (all else equal). Traders appear to agree with the GBTC’s discount to NAV reaching a 2-year low (15.87%).

GBTC has been trading below its NAV due to too much share supply for a Trust where you are unable to redeem shares for the underlying units of BTC. Converting to a spot Bitcoin ETF would enable the redemption mechanism and close the discount closer to 0%.

Coming full circle, arbitrage traders looking to get exposure to the discount narrowing (by being long GBTC) can hedge their directional exposure by shorting BTC spot.

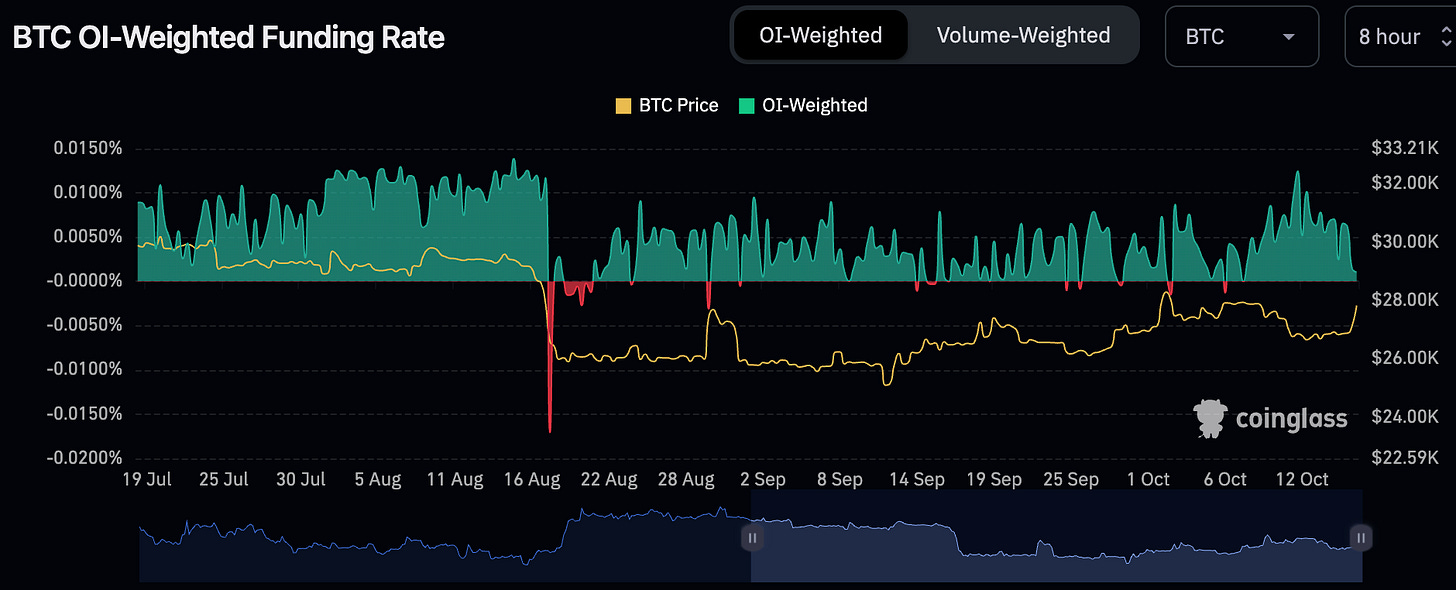

We can see that funding rates started to decline (lower highs) since ~11th October indicating traders were becoming more relatively short possibly from increased hedged GBTC positioning.

This created a set-up for a short squeeze driven by strong spot bids following the headline which was net positive.

The reason why this is important to track is that the volatility skew seems to be positive vs. negative when we look at key on-chain metrics.

BTC has been trading close to its production costs for much of 2023 which has acted as a reliable valuation floor since inception. Bitcoin’s production cost valuation model places a floor valuation at the cost it takes to mint 1 unit of BTC.

Today, that implied valuation floor is ~$22.4k or 17% below BTC’s price at the time of the SEC headline.

When it comes to seasonality, BTC is lagging in its performance so far in October where Q4 tends to be a performant period for the orange coin. So the current Bitcoin impulse aligns with monthly performance averages.

This isn’t just a Bitcoin story either. It’s a risk asset story in general. The S&P 500 is catching up to its seasonality performance since we last reported this last month.

Flows - A Changing of the Tide?

While SEC headlines may drive price action, what matters more is arguably flows. In other words, identifying how and when the crypto economy can grow in a tightening environment will be key for projected more sustained price action.

Just like any economy, crypto needs external flows in order to fuel growth.

Total stablecoins supplies in the crypto market have declined 27% from their peak in April 2021, from 151B to 110B.

One key catalyst for the supply decline has been the higher treasury yields that investors are able to achieve with cash outside of the cryptoasset market thanks to the tightening monetary policy by central banks. Low single-digit stablecoin yield within DeFi just simply didn’t cut it anymore.

What’s interesting is that we can also see the decline in stablecoin supply started when the US 2 Y note broke the 2% level - a marker for inflation going above the Fed’s 2% inflation target.

Simply put, higher rates to tackle higher prices meant higher outside yields.

Now there are early signs that the tide may now be turning. The rate of negative change in stablecoin supply appears to be slowing and on track to reach positive territory by year-end.

But US debt surpassing $33T amid a ballooning federal deficit and a huge wave of treasury bills is becoming unsustainable longer-term without some control intervention. The limited ability for treasury yields to increase significantly higher may the opportunity cost to miss out on on-chain yields to start to change.

Real yields for a number of proof-of-stake networks like ETH (4.8%) that account for token burns remain impressive and just shy of the current US 2-year note at 5.07%.

Directional investors also have the asymmetric upside opportunity on top of the high potential real yield component.

It’s unclear when exactly the tide changes for flows. What’s more clear are the incentive mechanisms that drive the changing of the tide. And it appears we are moving closer, not further away, to a net inflow environment for crypto.

Frax v3

We are seeing instances of DeFi protocols leveraging real-world assets (e.g. outside treasury yield) and turning that into tangible revenue for the respective network and in some cases the token holders themselves.

Today, real-world assets have grown from a $120m market to a $2.2B market in one year.

Frax released sFRAX as part of its broader V3 launch. FRAX holders can stake their stablecoin into vaults where the protocol deploys these assets to source yields that closely match the interest on the IORB rate.

Today, sFRAX’s APY is now 6.63% with sFRAX with 40m FRAX staked by 200 holders (6% of the total FRAX supply). In Frax’s case, a portion of network revenue will be given to staked holders of FXS - the governance token of Frax.

The key point here is that new net inflows don’t have to be driven by capital allocators investing in specific assets. It can equally be sourced from off-chain assets (like treasury yields) which are more likely to be bolted on to stablecoin supplies.

And it’s these stablecoin supplies that are poised for higher growth with or without interest rates staying higher for longer.

And that’s called asymmetry.

A Concern Alleviated

In other news, SOL has outperformed the market over the past week (+3.14%) as the FTX Bankruptcy estate chose to stake $122m SOL which is just a fraction of the $1.16B of SOL the estate has.

One of the key concerns of investors has been the supply overhang of the estate that may look to sell vested assets in the market over the years.

The opposite strategy may now be more likely as the estate of keeping supply off the market as they look to earn a significant amount of rewards by securing the Solana network via staking over several years.

RxR’s Latest Thematic Research

On Ethereum's Valuation

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to RxR Research below: Disclaimers The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all…

Lewis Harland Featured in OurNetwork’s Latest Edition

Global Market Cap

$1.056T; Markets are up 1.6% so far on Monday with eyes on the 200d MA as resistance. Weekly RSI is neutral at 48 with no divergences.

Bitcoin Dominance

51.24%; Bitcoin dominance continuing to edge higher after bouncing off YTD support. We still see 52% as likely the next resistance zone. The path of least resistance remains up as Bitcoin has the clearest known flow catalysts as well as most liquid for investors to position in.

Alts

$210.4B; The Alt coin market bounced off its YTD support towards wedge resistance at $217B. Breakout is expected to occur before mid-November 2023.

DeFi

$41.8B; The sector has put in higher lows as the YTD support trend. Appears traders are now placing support above $40B with the key level to break being $45B (+7.4%).

Trader Positioning

BTC; BTC OI weighted funding rates declined since last Wednesday which could be driven by GBTC arbs taking out more hedged positions. Equally could show traders taking risks off with BTC’s Monday move higher.

Increasingly negative funding rates may create further positive impulses.

ETH; ETH OI weighted funding rates more consistently positive (0.0024%) supporting the GBTC arb theory.

Grayscale Trusts

GBTC; GBTC’s discount to NAV narrowed to 15.87% effectively representing the likelihood of Grayscale spot Bitcoin ETF conversion.

ETHE discount also widening (25.5%) as ETHE is likely to mirror the outcome of GBTC should it be confirmed as a non-security by the SEC but the timing is less clear.

BTC/USD Aggregate Order Books

Order books look even. Heavier resistance up to ~$28.3k.

Miners

Significant increase in miner hash rate over the past week which is now up 69% YTD (426m TH/s). Operators are doubling down on resource commitment with a number of miners stating improved uptime and decreased curtailment as being key drivers of growth.

Hashprice (defined as hash rate / price) has increased as resources committed by miners outpace valuations. MIners were doubling down in a similar fashion leading up the previous halvening event (red) and it’s possible we see further climb in hashprice before valuations ‘catch up’ with the security budget placed by miners.

Top losers centred around select L1 and L2 names. Clear performance dispersion within the market with money being rotated between names vs. net new inflows rising tides across the board.

Top 100 (7d %):

Trust Wallet (+18.8%)

Rollbit Coin (+16%)

BitcoinSV (+13.2%)

Klaytn (+12.0%)

MultiversX (+8.5%)

Bottom Top 100 MCAPs (7d %):

Radix (-16.1%)

Mantle (-13.6%)

Tokenize Xchange (-6.6%)

Bitget Token (-3.9%)

Polygon (-3.3%)

> Ethereum Enshrinement 101 [Bell Curve]

> How Onchain Attribution Will Catalyze Crypto’s Growth [Lightspeed]

> Decentralized Storage, AI, and Blockchain Convergence [Money Reimagined]

> Zerion Web3 Wallet UX 2.0 [Epicenter]

> The Pros and Cons of Launching ZK on Ethereum and Optimistic Rollup Concerns [Delphi Podcast]

> Tokenisation of Real World Assets [Jamie Coutts]

> Crypto wallet MetaMask removed from Apple's app store [Axios]

> Ferrari to accept crypto as payment for its cars in the U.S. [CNBC]

> KYC for Uniswap [Scott Melker]

> Dune Dashboards on RWAs [Tom Wan]

Key RxR Links:

> Republic Crypto

> Re7 Capital

> Republic Group

About RxR

RxR is a fund partnership between Republic Crypto and Re7 Capital that leverages Republic Crypto’s leading Web3 advisory, venture capital, enterprise-grade infrastructure and treasury management capabilities, with Re7 Capital’s DeFi expertise and technology.

About Republic Crypto

Republic Crypto is a leading Web3 advisory with full-stack solutions for launching digital assets through consulting, token design and minting, and issuance solutions.

About Re7 Capital

Re7 Capital is a DeFi firm specializing in blockchain yield-seeking strategies. Its analytics engine gathers real-time data from 200+ protocols across stablecoin and ETH liquidity pools.